A series of free income tax preparation programs are scheduled for Northern Arizona through April.

The sessions are presented by the Volunteer Income Tax Assistance Program (VITA), which generally offers free tax help to people who make $58,000 or less and need assistance in preparing their own tax returns.

Partners include the Flagstaff Unified School District, the City of Flagstaff, Coconino County, Goodwill Industries, Wells Fargo Bank and the United Way of Northern Arizona.

IRS-certified volunteers will provide free basic income tax return preparation with electronic filing to qualified individuals in local communities.

IRS-certified volunteers will provide free basic income tax return preparation with electronic filing to qualified individuals in local communities.

The volunteers will inform taxpayers about special tax credits for which they may qualify such as the Earned Income Tax Credit (EITC), Child Tax Credit and Credit for the Elderly or the Disabled.

EITC is the nation’s largest anti-poverty program. Families with three or more children may receive a credit of up to $6,143 in 2014. The maximum credit is $5,460 for families with two children, $3,305 for families with one child, and just $496 for those without children, according to information provided by the Tax Policy Center, a joint project of the Urban Institute and the Brookings Institution.

VITA sites are generally located at community and neighborhood centers, libraries, schools, shopping malls and other convenient locations.

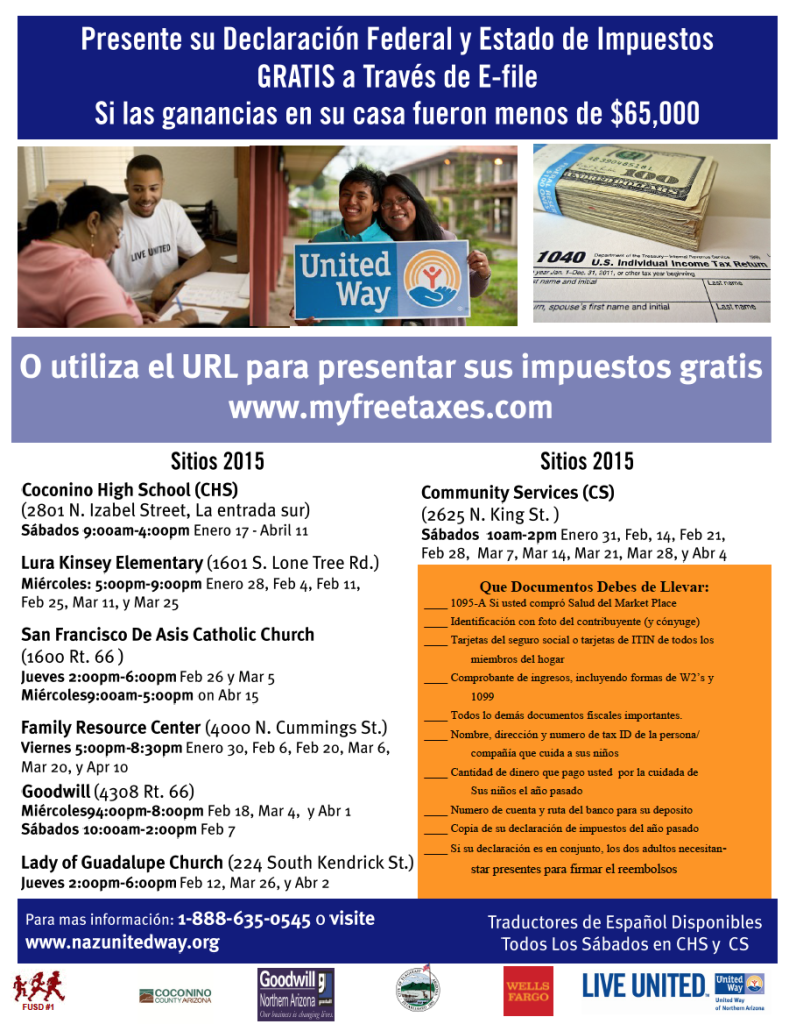

In Flagstaff, VITA sessions will be held at Coconino High School, Laura Kinsey Elementary, San Francisco De Asis Catholic Church, the Family Resource Center, Goodwill, Community Services and Our Lady of Guadalupe Church.

Spanish translators will be available Saturdays at Coconino High School and Community Services.

Tax filers must bring a Social Security card (SSN) or an Individual Taxpayer Identification Number (ITIN) for each family member, W-2 forms for all jobs worked in 2014, all 1099 forms for other income earned, photo identification for each adult filing, childcare provider information, proof of health insurance, 1095A if you purchased healthcare from the Market Place, and a cancelled check for direct deposit of refund. Bringing a prior year tax return is helpful.

Click on flyers on this page, call 1-888-635-0545 or visit www.nazunitedway.org for more information.

Northland Free Tax Assistance is also providing a free certified tax assistance program in Flagstaff. Its mission is to provide free tax assistance to low-income families in northern Arizona.

Certified Tax Preparers with the program will be operating one VITA site through April 12 at the Family Resource Center, 4000 N. Cummings, (across from the Flagstaff Mall) on Saturdays for those with household income limit at or below $58,000.

Certified Tax Preparers with the program will be operating one VITA site through April 12 at the Family Resource Center, 4000 N. Cummings, (across from the Flagstaff Mall) on Saturdays for those with household income limit at or below $58,000.

All Northland Free Tax Assistance preparers are certified under the IRS VITA program.

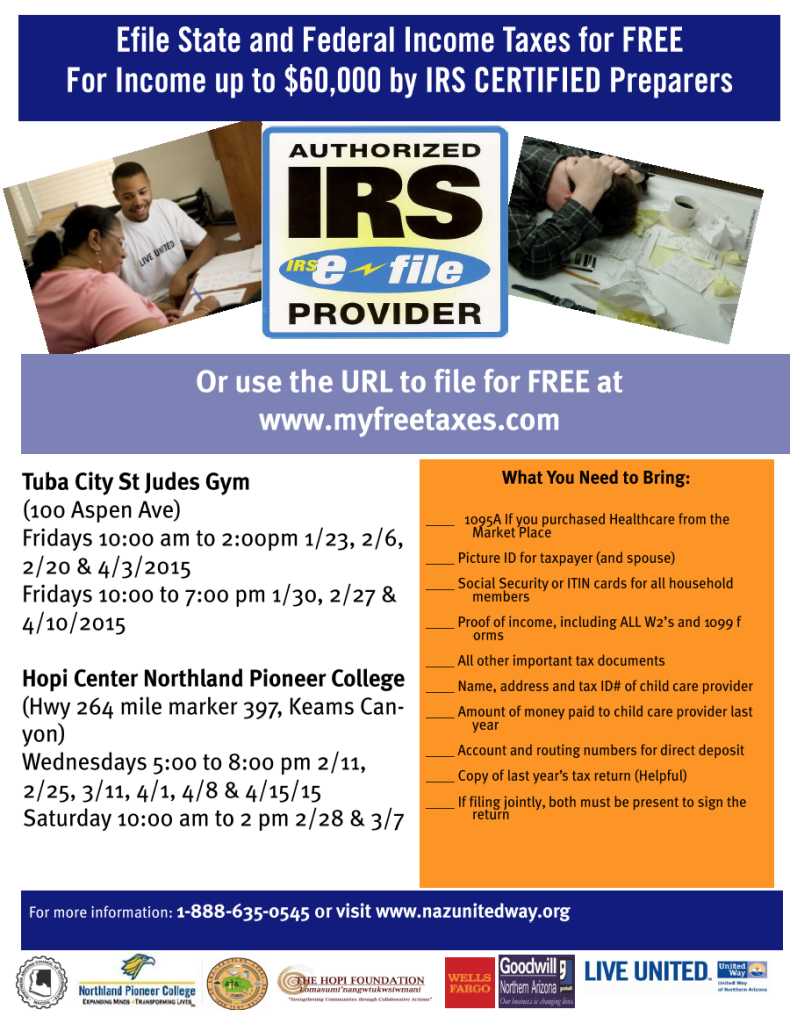

Tuba City

Tax assistance is also being provided in Tuba City, Coconino County Supervisor Lena Fowler’s Office and St. Jude Food Bank reported.

Tax assistance is also being provided in Tuba City, Coconino County Supervisor Lena Fowler’s Office and St. Jude Food Bank reported.

The sessions will be held from 10 a.m. to 2 p.m. Feb. 6, 20 and April 3 and from 10 a.m. to 7 p.m. Feb. 27 and April 10 at the St. Jude Gym, 100 Aspen Road, Tuba City.

All service providers are encouraged to participate at the VITA site by setting up a booth to provide program descriptions, brochures, or other offerings to the individuals and families who are utilizing the VITA site.

They can register by calling Miranda Keetso at 928-283-4518 or by sending her an email at mkeetso@coconino.az.gov

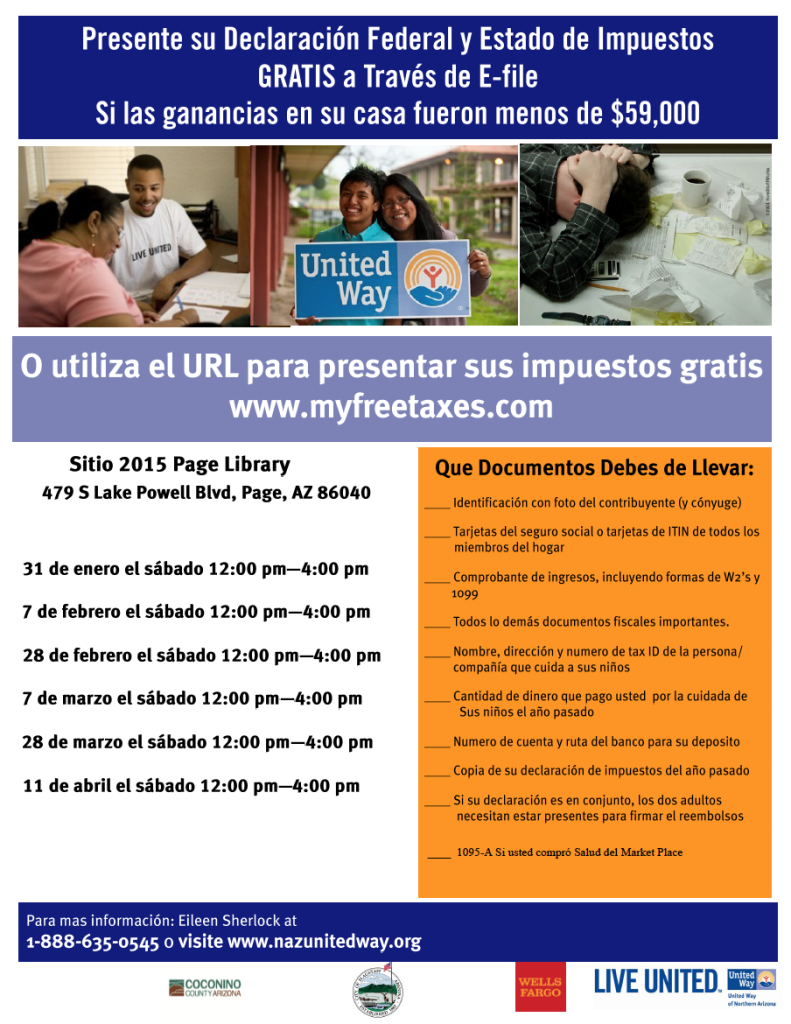

Page

Tax assistance is also being provided in Page from noon to 4 p.m. Saturdays, Feb. 7, 28, March 7, 28 and April 11 at the Page Library, 479 S. Lake Powell Blvd., Page.

Click on flyers on this page, call Eileen Sherlock 1-888-635-0545 or visit www.nazunitedway.org for more information.

Click on flyers on this page, call Eileen Sherlock 1-888-635-0545 or visit www.nazunitedway.org for more information.

Electronic filing also available

Also available for those individuals who want to file their own tax returns is the online site http://www.myfreetaxes.com.

The interview-based software allows eligible taxpayers to prepare and file for free their federal and state taxes online. The target population for this program is single filers who are computer savvy, those who have W-2 forms for each job held in 2014, have 1099 or 1098 income forms showing other income (unemployment, Social Security, school loans, health-care reimbursement, state tax refund, gambling winnings, contract work) and those who possess an email address.

Individuals or families with a combined income of $60,000 or less in 2014 are eligible.

Individuals or families with a combined income of $60,000 or less in 2014 are eligible.

The tax preparation checklist includes:

1) Gather your documents

- W-2s for each job held in 2014 for each person in the household; this form reports your name, wages and other tax information to the IRS.

- 1099s showing other income (unemployment, Social Security, school loans, health-care reimbursement, state tax refund, gambling winnings, contract work) that is reported to the IRS.

- 1098s showing payments you’ve made (school loans, property tax).

- 1095-A if you received credit from the healthcare.gov marketplace.

- Income/interest statements for any savings account/investments.

- Bank account numbers: a voided check or your bank or credit union’s routing number and savings or checking account number for your refund to be deposited automatically into your account through direct deposit.

- Last year’s tax return (if you have it).

2) Collect information for everyone in your household

- Name and taxpayer number as they appear on the SSN card or ITIN letter for you and all dependents (including children and elderly relatives for whom you provide care).

- Date of birth and relationship (son, daughter, mother, etc.).

- Current address (it may be different from the address on your employment records).

3) Gather additional items to get a larger refund

- Childcare expenses: name, address, tax ID or SSN of the childcare provider.

- Business expenses and assets: if you’re self-employed or have a small business

- College: loans and/or scholarships received, and bills for technical/community college or university (Forms 1098-T/1098-E).

- Educator expenses for teaching grades K-12 (school supplies and materials used in the classroom).

- Charitable donations: list of contributions and amounts, receipts for contributions over $250.

- Vehicles: vehicle sales tax, personal property tax statement for each car you own, total miles driven for the year and/or total miles driven for business.

- Renters: amount of rent paid (in some states).

- Homeowners: mortgage interest statement (Form 1098), real estate taxes paid, Statement of Property Tax Payable in 2014.

- Retirement/IRA: amount contributed to an IRA and total value as of December 2014.

- ITIN: If you need to apply for an ITIN for yourself or a family member, find out what other documents you need to take with you when you get help filing your taxes for free.

4) File your taxes for free through www.MyFreeTaxes.com

5) Keep copies of your forms and tax statements

For your protection, keep any forms used to prepare your taxes and a copy of your return for seven years. This information will make it easier to file your taxes next year.